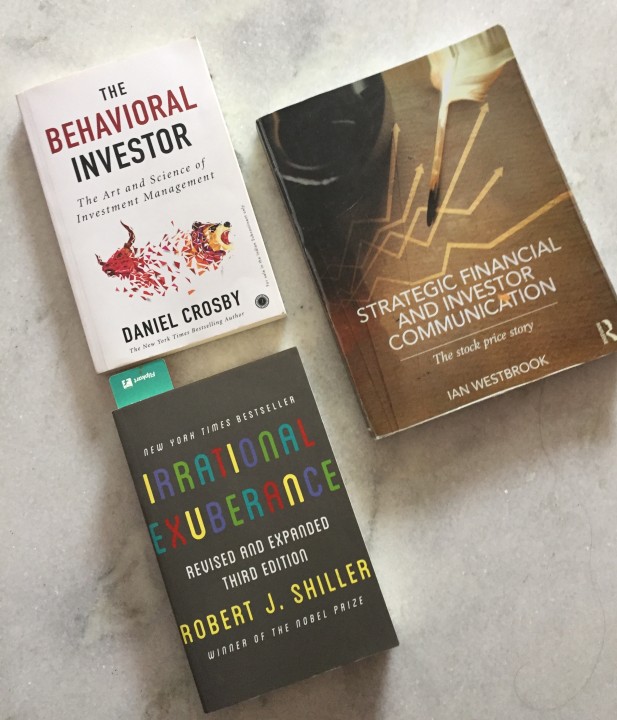

Readings on IR

Most of the management theories are successful methodologies thought processed and preserved with ingredients so that proven methods can be distributed and consumed by many. Believe me there are no conflicts between theory and practice.

Someone who does not believe in theory without referring to any textbooks might have developed a successful methodology. Once such a methodology is developed and upon finding it successful it must be converted to theory so that it gets preserved, and practitioners can consume it. Few theories come from pure research and even those must be tried.

The other way around, those who are more engrossed in theories must try to convert the ideas close to their hearts- gathered from books into practice.

When it comes to Investor Relations there are not many management schools in India having it in the curriculum. At the most it goes upto subjects related to capital markets. Most learn it from practice. There are many successful IR professionals in India, but I am yet to find titles authored by them.

They are plenty from the developed world and I have few. The best in my little collection is Ian Westbrook’s “Strategic Financial and Investor Communication” published by Routledge. This titled is in line with the popular theory of “Efficient Market Hypothesis”

I am not good in book review so I would suggest those who reading this post / article to visit the amazon link

https://www.amazon.in/Strategic-Financial-Investor-Communication-Stock-ebook/dp/B00JGQ5O2S

After an overdose from this title its good to read the best seller “ Irrational Exuberance by Robert J Shiller and when threatened with his theory read The Behavioral Investor by Daniel Crosby …